As 2012 draws to a close, economists have something bigger to worry about than the end of the world. A series of automatic, across the board tax increases and spending cuts totaling $109 billion, dubbed “the fiscal cliff,” will come in to effect on Jan. 1 if Congress fails to agree on economic policies for the next year. Economists warn that the dramatic measures could plunge the U.S. economy back in to a deeper recession and wipe out the effects of the slow and weak recovery of the past four years.

As 2012 draws to a close, economists have something bigger to worry about than the end of the world. A series of automatic, across the board tax increases and spending cuts totaling $109 billion, dubbed “the fiscal cliff,” will come in to effect on Jan. 1 if Congress fails to agree on economic policies for the next year. Economists warn that the dramatic measures could plunge the U.S. economy back in to a deeper recession and wipe out the effects of the slow and weak recovery of the past four years.

“The Congressional Budget Office report of November 2012 projects a .5 percent decrease in real Gross Domestic Product if all the provisions of the Budget Control Act of 2011 take place,” economics teacher Sally Meek said. “The biggest decrease in real GDP is projected to take place in the first half of 2013 and the unemployment rate is predicted to rise to 2013 by the end of 2013.”

The tax increases and spending cuts triggered by the fiscal cliff aim to reduce the federal deficit, and mirror austerity measures kicking in across the Eurozone. However, those measures have been met with protests and rioting in countries like Greece and Spain, where unemployment rates have remained staggeringly high even as budgets are slashed.

“The situations in several Eurozone countries, such as Greece or Spain, are more serious than the situation faced by the U.S.,” Meek said. “These countries face significant hurdles in borrowing money. The U.S. can still borrow at low interest rates. However, if the public debt increases significantly from the current 70 percent of GDP, borrowing will be difficult. It will entail higher interest rates, and that will slow economic growth for a long period of time,” she said.

The so-called cliff will be a self-inflicted wound if it is put in to place. Just two years ago, Congress faced a similar task of approving the government’s budget for the year. The partisan divide in Washington proved too deep to overcome, and the only thing that Republicans and Democrats could agree on was to disagree at a later time: after the elections, to be exact. Neither side supported the measures they enacted, and would therefore be forced to compromise the second time around.

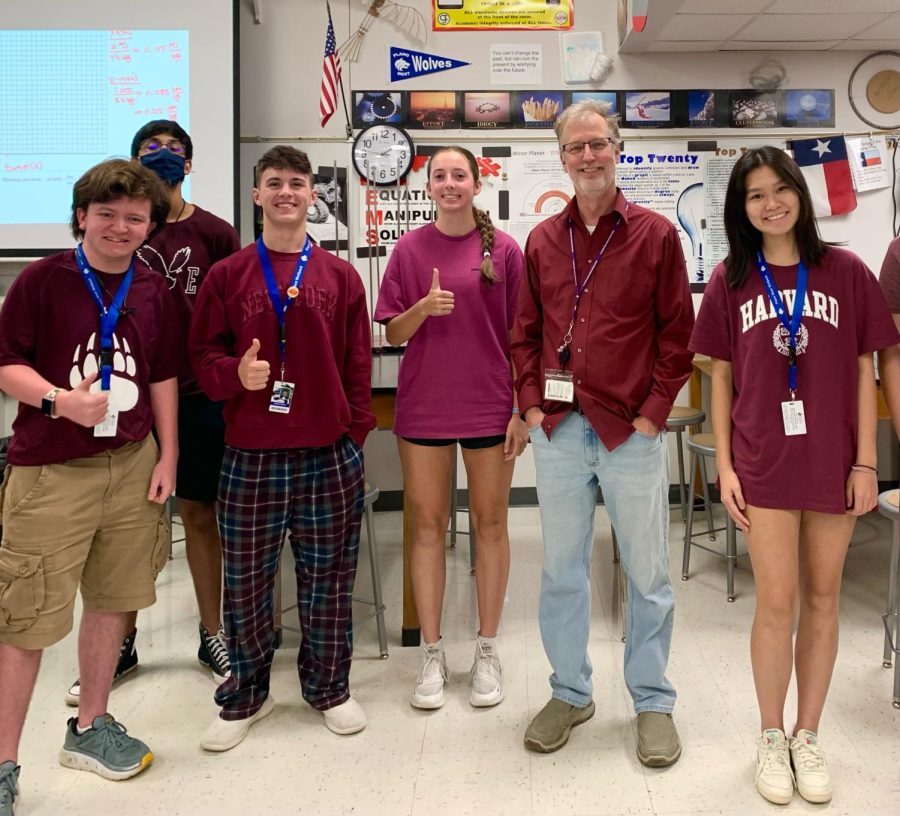

“Both parties have spent the last four years going head to head,” junior Marley Dubrow said. “Obviously, middle ground has to be found, and I highly doubt that Democrats or Republicans will allow us to fall off the fiscal cliff.”

One of the major issues that neither side can agree upon is whether or not to raise taxes for the wealthiest Americans by allowing the Bush tax cuts to expire. President Obama promised on the campaign trail that he would not renew the cuts and instead supported a return to higher tax rates under Clinton, who effectively oversaw a balanced budget and deficit reduction. On the other hand, Speaker of the House John Boehner recently said that Obama has no “mandate” to raise taxes. Yet the fact that Obama won re-election while campaigning on the very issue seems to indicate that the American people think otherwise. The payroll tax holiday enacted last year is also set to expire at the end of this year if no deal is reached. Coupled with unemployment benefits, the tax break proved to be more effective at stimulating the economy than the Bush tax cuts, according to the Congressional Budget Office.

“I think that raising taxes on the wealthy will only divide our politics more,” junior Jeffrey Han said.

The fiscal cliff is not just about taxes. Government programs are on the chopping block as well. Defense programs would face a 9.4 percent cut, while Medicare, Medicaid and Social Security, which contribute to a large share of the deficit, would remain mostly untouched. Safety net programs, such as food stamps and veterans’ programs, may face larger cuts. Other cuts include embassy security and the Federal Emergency Management Agency, both of which are political flashpoints in light of the Benghazi attacks this September and Hurricane Sandy last month.

“If you can’t pay for what you need without expanding the deficit, the only answer is a government shutdown,” junior Sara Harpole said. “It’s necessary to balance out the system’s extremes.”

While it is not clear if the parties in power on Capitol Hill will come to an agreement or simply kick the can further down the road, it is undoubtedly Americans across the board, from the poorest to the richest, who will feel the pain of tax hikes and spending cuts if our economy hurtles over the fiscal cliff.

“The ‘fiscal cliff’ is a short term issue, but the national debt and its impact on future growth is a longer term issue that must be resolved,” Meek said.